Want to Make Extra Money Now?

|

As more of us take out gigantic student loans and struggle to find the right jobs, we ask: Are student loans worth it or not?

As children grow up education is heavily enforced at a young age, the idea of college while being years away, feels right around the corner.

Whether wanting to be a doctor, a teacher or just follow your heart and pursue your dreams, it all takes one thing in common.

A degree.

A certification that shows dedication and education on a major that decides how to spend the rest of your life. While it seems frightening at first it certainly is the dream for many, ensuring their future for greatness.

What’s the Problem with Student Loans?

The problem that occurs is not attaining the degree but how to get it, whether it’s attending a university of some sort of trade school, it all cost one thing and lots of it: money.

This leaves students in a world of debt once graduating and then left competing for a high-end job to pay those student loans off.

This crisis is worse than many people think because of the misleading nature that the loans bring, they claim to help students and really are hurting them more than ever.

The Student Loan Crisis in 2022

In statistics taken in 2019 from the U.S. Federal Reserve student loan debt is as high as $1.56 trillion and 44.7 million Americans have student debt weighing their shoulders every day.

Many of these loans are taken out due to lack of financial aid given by the government, or even with financial aid help, the cost of tuition is too high (and currently rising).

But how much of a burden is it really for students?

Breaking Down the Student Loan Statistics

The student loan crisis is a larger problem than people realize because the amount of debt per student increases massively every year.

According to The Institute, the average student loan debt for the class of 2018 was $29,200.

Here are the latest statistics in 2022, according to Nitro College:

- Current U.S. Student Loan Debt = est. $1.53 Trillion

- 1 in 4 Americans have student loan debt: An est. 44.7 Million people

- Average student loan debt amount = $37,172

- Average student loan payment = $393/month

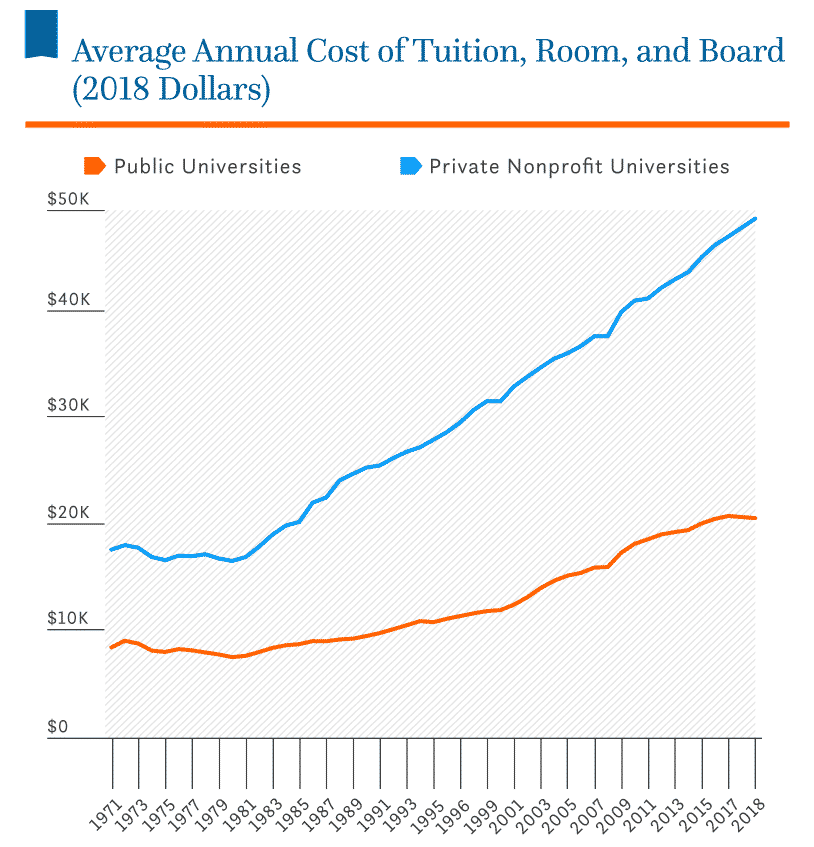

Student loan debt has ballooned in the past few decades, primarily because the costs associated with higher education – tuition, fees, housing, and books – have grown much faster than family incomes. The College Board has tracked costs at public and private universities since 1971.

The value of the American dollar, according to the current dollar index, has increased from 89 in September of 2009 to 103 in September of 2019, which shouldn’t be seen as having any effect of increasing debt.

While some of these issues seem blatant on paper, to the average student they can be nearly invisible until dramatically revealed.

This isn’t helped by the fact that little is explained to students beforehand. A good example of this — is refunds. If a student were to need $8,000 to pay for their courses and accepted a student loan, in many cases that loan would be granted in full even if the amount was $20,000. Then they would be issued a refund for $12,000. When a student accepts a refund like this, it drastically increases their debt further.

Students are not only misled by a system that propagates ignorance through lack of information, but they are also left in the dark about their ability to deny the refund.

In my experience, before I attended college, whenever the topic was discussed — refunds were viewed as if they were a free paycheck, and only after attending, did I become aware of the widespread misconceptions resulting from a flawed system, which was designed to encourage debt.

In addition, student debt can be increased by layered and hidden costs. Often, if a student asks about these costs, they will be denied detailed information. When information is revealed there may be questionable charges. Sometimes – for instance – students are charged for parking when they don’t own or operate a vehicle. Personally, this sounds borderline unethical as it appears to be charging for services not rendered.

I feel it is not the colleges themselves that are the root of this problem that is growing at a much more rapid pace than people realize. However, private for-profit colleges may be the exception to this opinion as they are designed to be profitable. The system itself and the boards that continue to utilize and encourage such systems desperately need to be broken down and restructured for the benefit of American education.

In any event, student loans are seen as an important investment to make to help further education but college students around the US stay in a constant state of worry because of the question that pops up almost too much, is it all really worth it?

So, Are Student Loans Worth It?

Yes and no. That really depends on what you want to do with your life.

Are Student Loans Worth it for Low-Paying Salary Jobs?

Taking teaching for an example, something that is vital to our society but also has the stigma for having a low paying salary, is it worth digging a grave of debt for a reward that is on the low end of the scale?

Are Student Loans Worth it for Doctors?

Even on the higher side of the scale, doctors and pursuers of Ph.D.’s involve themselves into a commitment of not only their job but paying off years of school. While the benefits might be worth it, in the end, they will have to settle with payments for what seems like an eternity.

What we see is following your dreams doesn’t always pay off and if it does the debt will still haunt you, but another problem arises, as the years pass and competition for jobs get tougher even more education is needed. And so, a never ending cycle is created.

What About Other Majors?

Many majors like those of liberal arts, and for this example, specifically psychology, a bachelor’s degree is simply not enough. Advising from others can tell you to not even think about the major itself if you aren’t willing to get a master’s degree or even a Ph.D.

More school easily equivalents to a higher chance of pulling out student loans, with an even higher chance of leaving with more student debt. The cycle that is created in the reliance on the loans, and for some it’s not by choice but last resort, the only way they can survive in the world of work.

So now loans lose the opportunity that is tied to them and are dreaded in the eyes of the beholder, but I mean who would want thousands of dollars of debt?

While all can certainly agree the word “loan” never brings a smile to a person’s face, the pressure that it brings is now deeper than ever and is only deepening day by day.

From the internal combat of defining the worth of your education into a dollar amount and with the increasing need of an even higher degree than originally intended the crisis is certainly a problem.

The moment something, like loans, become essential to live successfully but in reverse can hold many back is the moment everyone should open their eyes and realize: this is not only a disaster waiting to happen, but is a disaster in full affect.

What do you think? Are student loans worth it?

Disclosure: We earn a commission for this endorsement of Fundrise.